Standby, or Stand Firm? (Part 1)

Speaking truth to [time to] power. PJM just put out a bombshell new proposal (and not the good kind). Sorry, PJM.

AI and data centers absolutely dominate the energy policy discourse these days. Many readers are already familiar with the basics: data centers are poised to represent nearly half of all U.S. load growth from now until 2028, and in pockets of the country where they’re most likely to be deployed (Texas, Virginia, Pennsylvania, etc.), they will represent not just one of the biggest energy issues for policymakers, but one of the biggest issues period.

We’re already seeing the challenges of new data center deployments. AEP Ohio imposed a moratorium on new data-center hookups that lasted more than two years while regulators struggled to address grid costs. Just last week, the city council of College Station, TX unanimously shot down a land sale for a 600-MW data center campus, with residents citing strain on the grid as a key concern. And in a move that sparked a week’s worth of drama on Energy Twitter, the PJM Interconnection has proposed a restrictive new service category for large incoming loads: Non-Capacity-Backed Load (NCBL).

Today is Part 1 of a two-part series. In this installment, we’ll break down what NCBL actually does, what aspects of stakeholder backlash are on the mark, and why time to power is what dominates data center decisions. In Part 2, we’ll lay out the fixes—what “flexible load done right” might look like—and how to get there.

Flying on Flexible Fare

Suppose you’re flying from DC to Philadelphia—to pay a visit to PJM headquarters in Valley Forge, PA, of course. You can pay $180 for a guaranteed seat. But on that same fare-selection page, the airline makes you an offer: pay the bargain price of $110 for a standby seat instead. A “standby” seat means you board last and—if it’s a popular itinerary—you might get bumped to a later flight entirely.

For fast‑arriving, large loads on the electric grid (a term that’s quickly become a Pavlovian stand‑in for “data centers”), that’s the latest idea from PJM: you can pay one price for the guaranteed seat, or you can avoid the seat-reservation fee if you agree to fly standby and be first to get bumped when the plane is tight.

People do not like it. The Data Center Coalition says the NCBL proposal is too vague to operationalize. Constellation has accused PJM of gross jurisdictional overreach. Cy McGeady of Equinix says the proposal obviates PJM’s entire designed purpose of creating a capacity market in the first place.

So what’s going on? First, some background…

There Are Really Two Electricity Markets

Before we unpack the chaos unfolding at PJM, we should understand the two layers of electric service: energy markets and capacity markets.

Energy (kWh)

This is the way most of us are used to thinking about electricity: it’s a commodity that you consume. Prices swing with fuel, weather, and congestion. At month’s end, your bill reflects how much you used and when. In the energy market, generators are paid for how much they produce.

Capacity (MW-year)

This is like the insurance premium for the worst day of the year. You’re paying to ensure enough megawatts will be there when the system gets tight. In the capacity market, resources (a fancy umbrella term for generators and other power sources, including batteries and storage) are paid simply for being available, not for how much they produce.

Every U.S. ISO (Independent System Operator) and RTO (Regional Transmission Organization) runs energy markets. What differs is the reliability layer on top:

Centralized capacity markets (PJM, ISO-NE, NYISO).

These regions have formal auctions that secure future capacity and set a price for it. Consumers in these jurisdictions pay for both energy and capacity (though, as a household customer, you won’t see “capacity” itemized; it’s baked into the supply rate that your provider charges).Resource-adequacy programs (MISO, CAISO, SPP).

These regions don’t run a big capacity auction. Instead, regulators instruct each utility or retail supplier to prove that they’ve lined up enough capacity for a peak day, plus a reserve margin. If one utility company is short, the ISO can procure the deficit (using methods beyond the scope of this discussion) and charge the short party. Essentially, it’s capacity by proof, not by a single market clearing price.Energy-only (ERCOT).

In Texas, there is no capacity market. This is a laissez-faire approach where scarcity pricing is meant to attract investment. The basic idea is that if a shortfall does arise, there will be a natural incentive to build more resources in order to chase the lucrative marginal price during those moments of high demand. The result is more resources on the grid and improved reliability overall.

Belonging to the first of these categories, PJM solicits promises to meet capacity three years ahead through its Base Residual Auction (BRA). The BRA is PJM’s auction to identify generators who will pre-commit to meeting future demand at the lowest cost. The resulting clearing price at auction basically represents the price that customers will pay for carving out a “guaranteed seat” of 1 MW.

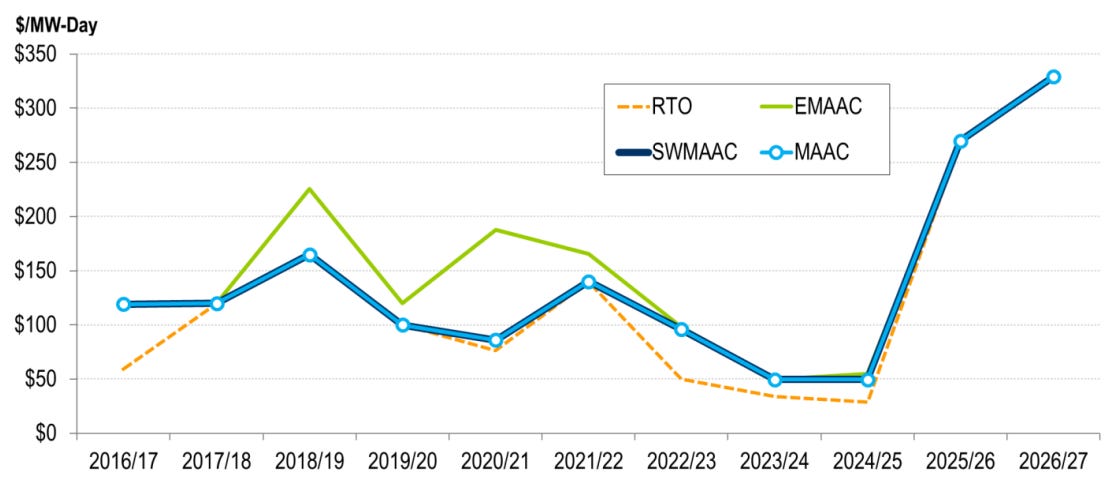

The capacity market price signal has exploded

PJM’s capacity auction cleared at $329.17 per MW‑day for 2026/27. It was $269.92 per MW‑day for 2025/26, which was an explosion from just $28.92 per MW‑day for 2024/25 the year prior. That’s a jump by over 800%! In essence, the recent shortfall in generation has meant an enormous premium being paid to those who can step up and guarantee availability.

That said, it’s worth emphasizing that the retail electric prices that residents see are a complicated business, and data centers certainly shouldn’t get all the blame. As frustrated ratepayers feel the pain of rising prices, it’s a picture that deserves more color (more on this in a future edition of Policy Gradients).

What is NCBL? A “Standby” Lane in PJM for Large Loads

Now, we’re ready to understand the capacity debate that’s been happening. Non‑Capacity‑Backed Load (NCBL) is a proposed lane for big new customers (generally ≥ 50 MW) willing to accept lower-priority service under certain rules. Stakeholder discussions are ongoing, and PJM has signaled an intent to file with FERC by year’s end, with operations targeting a delivery year of 2028/29 at the earliest.

NCBL does not pay a capacity charge. It is subject to pre-emergency curtailment.

NCBL is excluded from the BRA and associated capacity charges. In return, it can be curtailed under defined pre-emergency conditions, which are conditions of high demand that do not yet rise to the level of an emergency. In these scenarios, electric customers in the NCBL lane are the “standby” passengers who are first to be bumped.NCBL curtailment is PJM-instructed, utility-executed, and auditable.

Before the delivery year in which NCBL takes effect, it is the responsibility of each transmission owner (i.e., utility company) and participating customer (e.g., a data center) to agree on an operating procedure for curtailment: who calls whom, what constitutes minimum notice, ramp-down expectations, steps for restoring power, data reporting, and more. During a curtailment event, PJM instructs the transmission owner to curtail the load that is being served. Afterward, the transmission owner is responsible for sending telemetry data (i.e., before-and-after data from meters and sensors) to PJM for audit and verification that the load truly was curtailed.NCBL participants receive offsets for Bring-Your-Own-Generation (BYOG) and Demand Response (DR).

Bring-Your-Own-Generation (BYOG) is on-site generation that you own or control. Demand Response (DR) means voluntarily lowering your load in response to a grid signal during periods of high demand, typically in exchange for compensation. Customers under NCBL can credit BYOG and new DR to offset an equivalent portion of their flexibility obligation, since both BYOG and DR can reduce the ad hoc load that a customer poses to the grid. For example, if a hyperscaler were to build an on-site gas-fired power plant accredited at 100 MW and to add new DR accredited at 25 MW, their assigned quantity of NCBL could be reduced by up to 125 MW (though the exact math remains to be determined).NCBL is transitional.

PJM envisions NCBL as an interim measure given the grid’s current resource inadequacy.

But here’s the kicker that is making hyperscalers sweat: under the new proposal, PJM first seeks volunteers for NCBL status, but if a delivery year still falls short due to large-load additions, PJM can “allocate NCBL” (read: “force NCBL status upon you”) by area. In other words, you might be designated flexible whether you like it or not. Ouch.

There is nothing inherently wrong with flexibility. In fact, the flexible data center model could unleash a fantastic amount of untapped American power for AI (more on this in Part 2). But the concept recently proposed by PJM falls short of this framework in some crucial ways.

Where NCBL makes sense

NCBL gestures in the right direction, with ingredients for a product that could complement the capacity market rather than undermine it. Here are some aspects of the proposal that accord with a sensible conception of flexible load.

NCBL is still counted in grid planning.

Even if a customer elects the NCBL lane, PJM still counts that load in transmission planning. What this means is that although NCBL makes no financial contribution to capacity, the engineering contribution of the load does not go ignored. In the longer term, engineering studies will still take NCBL into account when properly sizing the grid.NCBL participants receive offsets for BYOG and DR.

As described earlier, customers can nominate BYOG resources and new DR to offset their own NCBL obligation. This is a good thing, as it allows important or sensitive loads to take matters into their own hands and invest in upgrades that reduce exposure to curtailment. Plus, this is a way for customers to contribute to grid reliability more broadly and ultimately help solve PJM’s resource inadequacy.NCBL is transitional.

As described earlier, PJM has proposed NCBL as a temporary strategy for dealing with rapid load additions. Say what you will about PJM’s recent performance, but even astute watchers of the grid have been caught off guard by the sheer speed and scale of the AI-driven surge in new load. Accordingly, some sort of transition plan is appropriate as we build toward a grid that can fully accommodate the demand for AI.

Where NCBL has issues

That’s about where the sensible stipulations end. Here are some less attractive effects of NCBL.

NCBL is removed from the BRA.

As described earlier, PJM’s Base Residual Auction buys commitments three years ahead to meet future resource needs. The BRA serves at least two vital functions.First, the BRA ensures the physical reliability of the grid. If NCBL is invisible from the auction, total capacity will be underestimated and underbuilt, jeopardizing long-term reliability.

Second, the BRA ensures that capacity is priced to reflect the value that consumers actually derive from it. Suppose that NCBL has been dished out across the grid at a quantity determined top-down by PJM. That portion of demand—hidden from the auction by the invisibility cloak PJM is proposing—has been treated as non-existent, which means capacity for that year will be underpriced. For perhaps no consumer class is this more distorting than the incredibly high-value use case of compute for AI. The current proposal also absolves NCBL of fair cost allocation with other grid citizens. Think of it this way. Have you ever had a colleague who shirked chipping in for a shared coffee machine—or furniture or some other group purchase—but went ahead using it anyway? Even if they pay for the coffee cups and pods that they use, they haven’t partaken in a fair cost allocation for the mere availability of the shared resource. There are certain fixed costs that complicate the picture too. It’s not great. Ironically, at a moment when data centers are coming under public fire and facing existential hurdles over cost causation, this move by PJM is more than a little tone-deaf.

Update 9/18/25: This paragraph revised based on feedback from Samuel Roland.

NCBL is tapped earlier in the curtailment order.

In the pre-emergency playbook, NCBL is curtailed before capacity-backed DR. This is a bit surprising. Traditionally, DR customers are ready to ramp down power in response to incentives, and some sophisticated customers are already doing so in real time. But under the new proposal, NCBL is an even lower-priority lane than DR, arguably exposing them to undue risk.It’s all fun and voluntary…until the mandatory backstop triggers.

This feature of NCBL has widened eyes, and it’s not hard to see why. As we’ve explained, in the case of a shortfall, PJM could just dole out NCBL status until the region meets capacity constraints for the year. But the whole point of a standby airfare class or a flexible lane to power is that it’s opt-in. It offers customers the option to voluntarily accept lower priority in exchange for some benefit, such as a lower fee. Stakeholders across the board consider this mandatory backstop to be heavy-handed—and understandably so—since it subjects customers to unsolicited service interruptions, all in order to address a shortage of grid resources that should have been solved on the supply side anyway (by building more generation).

Why Hyperscalers Are Freaking Out

It’s tempting to view NCBL as a “discount deal” that lures data centers with waived capacity fees. After all, in its own slide deck, PJM says that NCBL “could offer significant savings to participants.” But in reality, for hyperscalers, the capacity line item barely moves a go/no-go decision. Time to power does.

On the revenue spreadsheet, the variables that dominate are (1) energization date and (2) how fully a campus can run once it’s live.

While a 100-MW campus might “save” on the order of ~$12M/year by not buying capacity1, that’s pocket change relative to capex, supply-chain commitments, and the cost of letting racks sit dark. If GPUs have already been installed or even ordered, just a couple weeks of downtime eats multiple times those ostensible electricity cost savings2.

As Dean Ball, the lead architect of America’s AI Action Plan, put it to me in a recent conversation,

“Data center operators are accustomed to exceptionally high uptime (often more than 99.99% of a year), but in a world with rapidly growing data center costs and lengthening waits for new data centers to be connected to the grid, time is far more valuable than savings on the marginal cost of electricity.”

(Dean is also the author of Hyperdimensional, where you can find some of the most prescient and original thoughts on rapidly improving artificial intelligence. It’s telling—of the importance of the issue—that Dean chose to make his long-awaited return to Substack with “Out of Thin Air,” which puts a spotlight on time to power. The piece even includes complete draft text for an executive order meant to accelerate interconnection for large flexible loads.)

If we’re serious about building AI in America, we shouldn’t be waiving capacity fees as a measly carrot in return for the ability to cut data centers offline and tell them, “Tough luck!” If anything, hyperscalers might be willing to pay a premium in exchange for accelerated energization. Moreover, these premiums could go toward relieving some of the cost-causation (i.e., expensive upgrades to the grid) that’s partly fallen on the backs of residents in so many states.

Fixing the Flexible Fare

The Non-Capacity-Backed Load (NCBL) category proposed by PJM on August 18th, 2025, which poses an uncontrolled, open-ended curtailment risk and shifts costs onto people minding their own business, is dispositively negative for data center feasibility. It’s just not going to fly. But these problems are fixable. Under an opt-in, rule-based, fairly financed, and growth-incentivizing framework, flexibility need not be a burden. It’s our greatest opportunity.

Up Next

In Part 2, we’ll lay out the policy toolkit to make flexible load a real product—explicit, voluntary, and conducive to resource growth—that solves our real capacity problems.

Back-Of-The-Envelope Assumptions:

Capacity price: $329.17/MW-day (from BRA 2026/27)

Load: 100 MW

Annual capacity cost = Price × MWs × 365

= $329.17/MW-day × 100 MW × 365 days/yr

= $32,917/day × 365 days/yr

= $12,014,705/yr

Back-Of-The-Envelope Assumptions:

Site size: 100 MW

Share of site power for GPUs: 80%

Per-GPU power: 1.0 kW (e.g., Nvidia B200)

GPU count: 80,000 kW ÷ (1.0 kW/GPU) = 80,000 GPUs

Price/GPU (on-premise): $35k–$46,625 per Nvidia B200

Weighted Average Cost of Capital (WACC): 10%

Daily capital carry = Number of GPUs × Price/GPU × (0.10 / 365 WACC per day)

= 80,000 GPUs × $46,625/GPU × (0.10 / 365 WACC per day)

= $3.73B × (0.10 / 365 WACC per day)

= $1.02M/day

Comparison to capacity charge:

The idle-GPU carry is $1.02M/day.

The capacity charge was $32,917/day.

That means the idle-GPU carry is ~31 times higher!

A one-week delay to turning on chips ($7.2M) amounts to 60% of the $12.0M/year capacity fee.

A two-week delay to turning on chips ($14.3M) exceeds the $12.0M/year capacity fee.